About Banks renewable energy

Since the Paris Climate agreement, Wall Street’s big banks like Wells Fargo and JPMorgan have backed fossil fuel driven projects. In 2021, they’re all on pace to lend more to green and climate friendly projects.

“We may well be at a powerful tipping point,” said Tim Buckley, a clean-energy investor who spent nearly two decades at Citigroup Inc. “Finance will only lead when the numbers make sense.” The long wait for finance to ditch major sources of planet-warming.

All figures since 2016, after the signing of the Paris Agreement.

To measure the involvement of each bank, Bloomberg Green examined the bonds and syndicated loans underwritten for companies that produce or extract oil, natural gas and coal.

The biggest Western oil companies—Exxon Mobil, Chevron, BP, Royal Dutch Shell, Total, Eni and Equinor—have issued $13 billion of debt in 2021, down from $60.

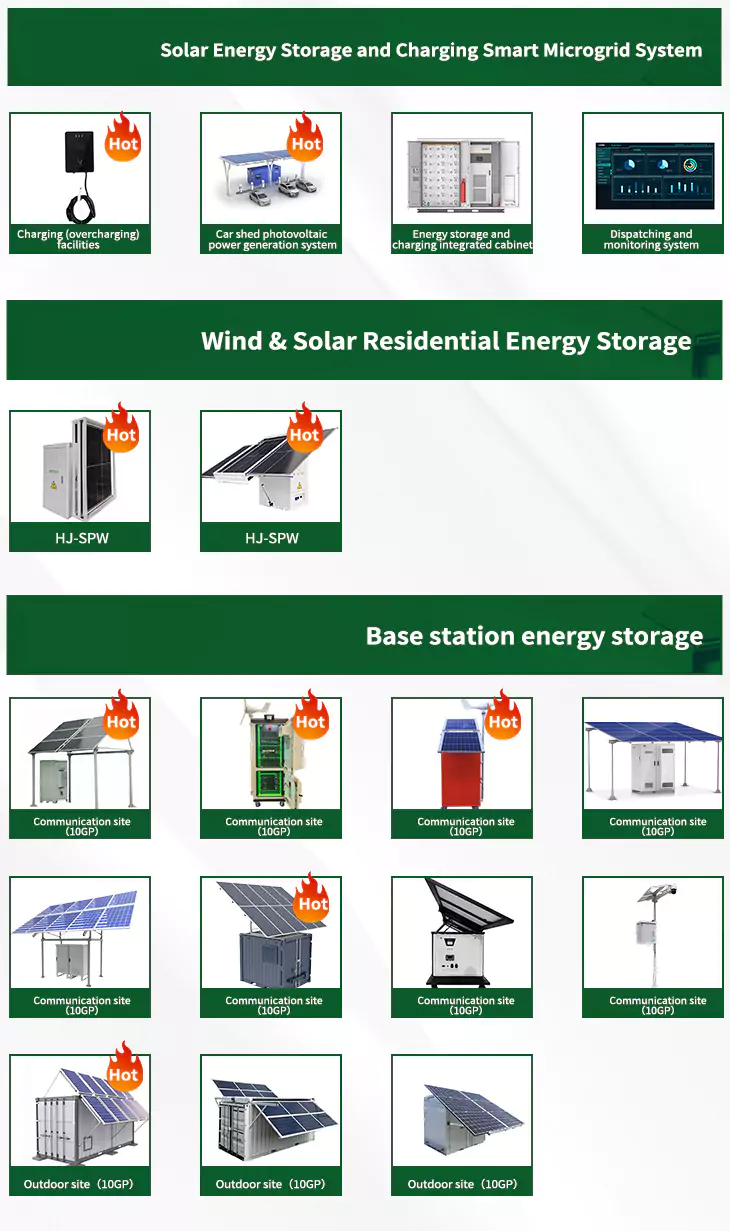

As the photovoltaic (PV) industry continues to evolve, advancements in Banks renewable energy have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Banks renewable energy for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Banks renewable energy featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- Cooperate with banks to promote energy storage

- What are the renewable energy storage devices

- Renewable energy supporting energy storage

- Renewable energy storage demand

- Renewable energy storage jobs

- Side energy storage renewable energy

- New policy on renewable energy storage

- Green energy vs renewable energy

- Orchid renewable energy

- Renewable energy in oil and gas industry

- Renewable energy consultant job description

- What are three renewable sources of energy